Risk in the international supply chain is everywhere. Whether it is raw materials headed to your factory or finished goods going to your distribution center, the risk of loss or damage is always present. To succeed in the global marketplace, companies must constantly monitor risk factors that could negatively impact their financial position.

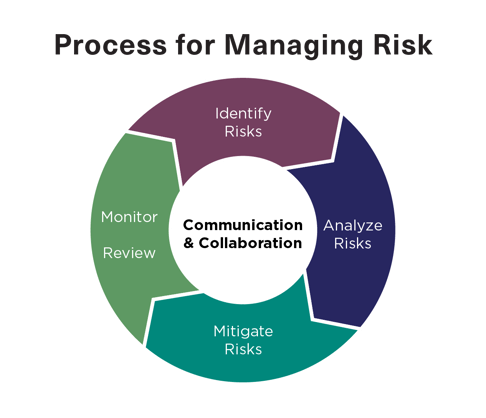

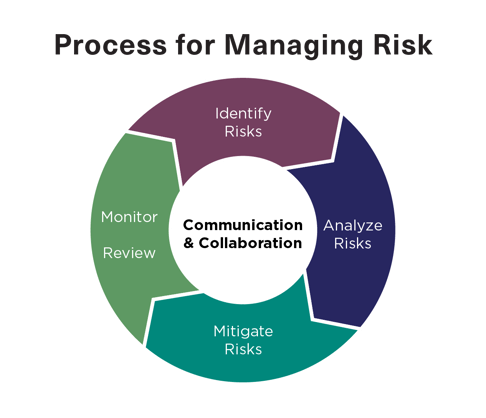

By following the traditional process of managing risk, as outlined below, your organization can take a holistic approach to examine the financial exposure that cargo loss or damage presents.

- Identify Risks: The first step is to understand where your freight is moving throughout the supply chain. This step is designed to identify at what points an organization is most at risk for the goods in the supply chain. Once your risk exposure is identified, you can then begin to look at other critical factors such as the value of the goods, the shipping lane, the mode of transit, and the packaging. You will then need to assess potential hazards based on the risk exposure analysis.

- Analyze Risks: Risk analysis involves looking at your supply chain, determining the probability that you will sustain losses, and how severe those

losses could be. The global movement of cargo renders this exercise difficult as no one can predict acts of nature or civil unrest with complete certainty. Your logistics provider will be able to provide some quantitative data, but there are a number of unique variables, such as commodity, packaging, mode, and carrier, that can diminish the reliability of that data.

- Implement Risk and Mitigation Controls: While it is impossible to eliminate the risk of loss in any supply chain, there are plenty of risk mitigation techniques to evaluate for your organization’s needs. The decision will need to be made as to whether one feels the implemented mitigation techniques are sufficient enough to reduce the risk of loss to an acceptable level. Due to the uncertain nature of supply chains, nearly every company purchases cargo insurance. This allows a company to transfer the financial risk of loss to the insurance company for a premium.

- Monitor and Review Risk Controls: Continual monitoring of your loss history is critical to ensuring your losses are within your tolerance level. A high number of losses may result in increases to your insurance premiums, dissatisfied customers, and possible line-down situations. Cargo insurance is an effective way to protect yourself from unpredictable and unexpected losses, while additional risk mitigation techniques minimize the frequency and severity of claims.

ECIB provides innovative, logistics-focused risk management solutions through a data-driven approach to insurance and claims, in-house expertise, and superior service that enables our clients to better manage the risks in their supply chain. If you like to learn more about supply chain risk management, contact our experts.

.png?width=6181&height=1578&name=ECIB-logo%20(1).png)